22+ ri paycheck calculator

For example if an employee earns 1500. From 89075 to 170050.

Lineaeffe 2021 En By Oleg Kadnikov Issuu

The tax rates vary by income level but are the same for all.

. Step 6 Minus everything. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. It is not a substitute for the.

The Rhode Island Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and. Rhode Island Income Tax Calculator 2021. Rhode Island has a progressive state income tax system with three tax brackets.

Employers pay between 099 and 959 on the first 24600 in wages paid to each employee in a calendar year. Supports hourly salary income and multiple pay frequencies. Rhode Island Salary Paycheck Calculator.

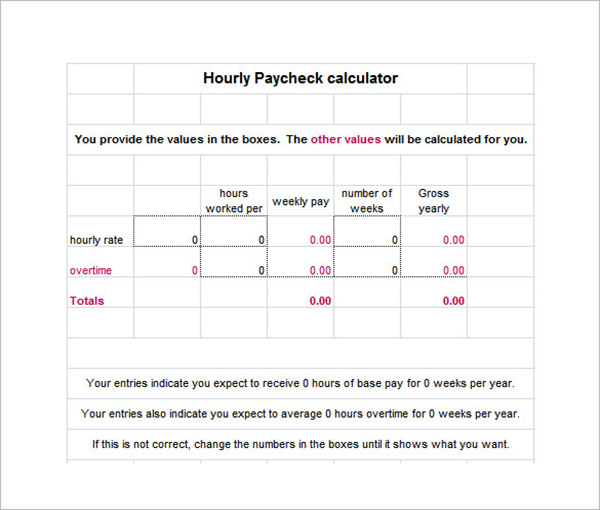

How to calculate annual income. If youre a new employer congratulations by the way you pay. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Estimate your take home pay after income tax in Rhode Island USA with our easy to use and up-to-date 2022 paycheck calculator. Calculate your payroll tax liability Net income Payroll tax rate Payroll tax liability minus any tax liability deductions withholdings Net income Income tax liability Payroll. Your average tax rate is 1198 and your.

Calculate your Rhode Island net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. Overview of Rhode Island Taxes. Just enter the wages tax withholdings and other information required.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Rhode Island residents only. Once you have worked out your total tax liability you minus the money you put aside for tax withholdings every year if there is any and any post-tax. This Rhode Island hourly paycheck.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Use ADPs Rhode Island Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

This free easy to use payroll calculator will calculate your take home pay.

Ilog Cplex 11 0 User S Manual

![]()

Free Rhode Island Payroll Calculator 2022 Ri Tax Rates Onpay

Free Paycheck Calculator Hourly Salary Smartasset

34 Benefit Street Apartment Homes 34 Benefit Street Providence Ri Rentcafe

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

2022 Salary Paycheck Calculator 2022 Hourly Wage To Yearly Salary Conversion Calculator

Write An Expression That Concatenates The List Feb Temps To The End Of Jan Temps

Rhode Island Salary Paycheck Calculator Gusto

Texas Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

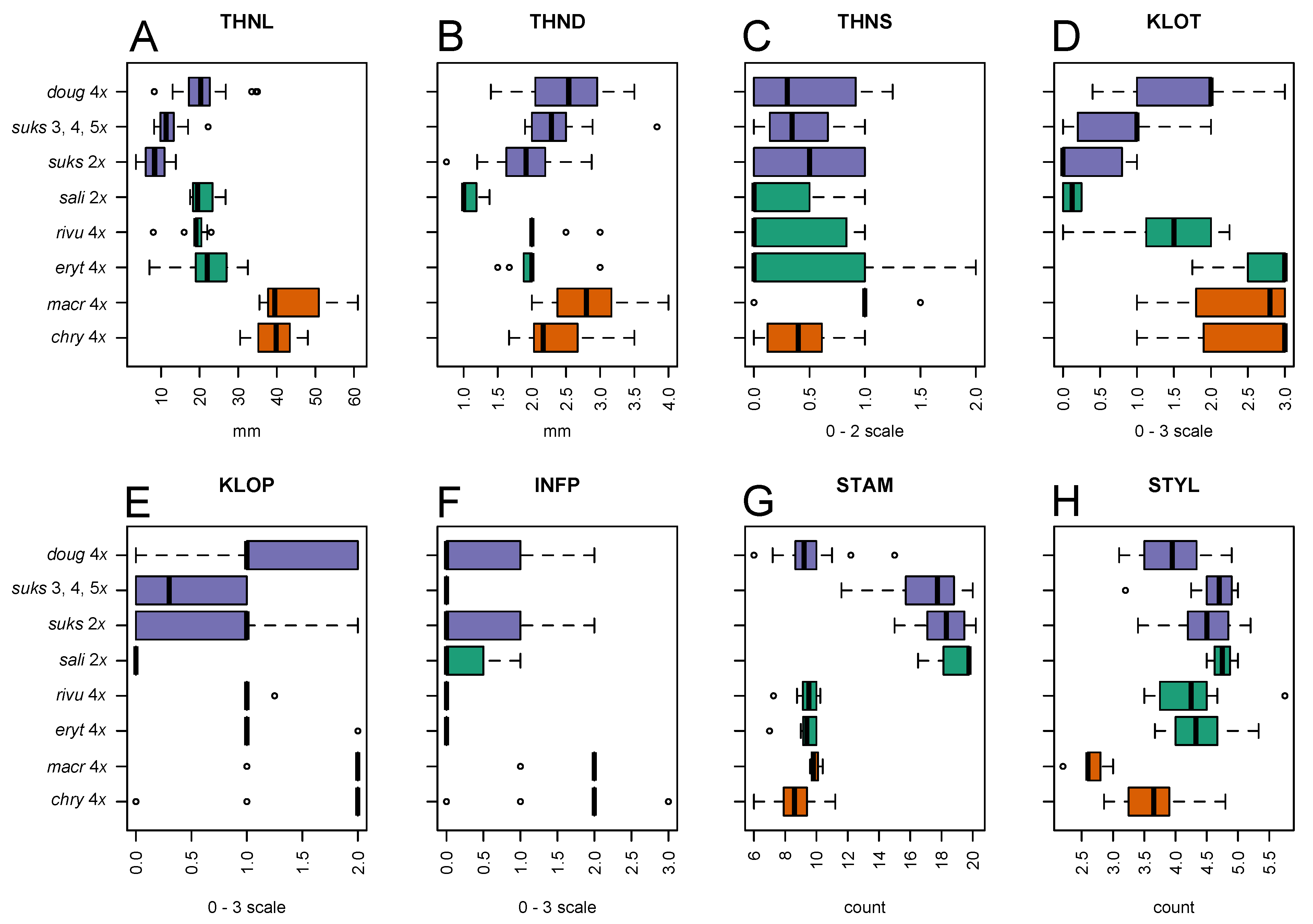

Agronomy Free Full Text Niche Shifts Hybridization Polyploidy And Geographic Parthenogenesis In Western North American Hawthorns Crataegus Subg Sanguineae Rosaceae Html

Free Paycheck Calculator Hourly Salary Usa Dremployee

12 Salary Paycheck Calculator Templates Free Pdf Doc Excel Formats

Pdf Prion Diseases Neuromethods 129 Salvador Eduardo Acevedo Monroy Academia Edu

Coade Pipe Stress Analysis Seminar Notes Pdf